China has become the world’s most important center for electric vehicles, growing faster than any other market over the past decade. Today, Chinese automakers are not only competing at home—they are shaping global trends in battery technology, design, and smart driving. As the demand for EVs keeps rising, the need for reliable EV charging stations and advanced EV charging solutions is also expanding across cities, highways, and business fleets. Many EV charging equipment providers in China are working closely with car brands to support this growth, creating a strong ecosystem around the entire industry.

This article gives a simple, clear look at the top electric vehicle manufacturers in China and why they matter. Instead of focusing only on sales numbers, we also consider innovation, long-term strategy, and contributions to the global EV landscape. Whether you are a business owner, a technology professional, or just curious about the future of clean transportation, this guide can help you understand who the major players are and how China became a leader in the EV world. It also highlights the important role that charging technology and infrastructure play in supporting the next generation of electric mobility.

China EV Market Overview

China’s electric vehicle market is the world’s most dynamic, rapidly evolving from a protected domestic sector into the global standard for scale, speed, and cost efficiency.

NEV and BEV Market Scale and Growth Trends

The Chinese market is defined by explosive growth, driven by both pure battery electric vehicles (BEV) and new energy vehicles (NEV), which includes plug-in hybrids and range extenders. This transition is taking place at an unprecedented scale: NEV sales are projected to reach over 11.8 million units in 2024, claiming roughly 40% of the total domestic passenger vehicle market (Source: China Automotive Industry Association, Q4 2024 Estimates). This market momentum is fundamentally reshaping global transportation faster than any other region.

Driving Factors: Policy Support, Cost Advantages, and Technology Breakthroughs

This dominance is not accidental, but rooted in comprehensive government support, including early subsidies and the crucial Dual-Credit Policy, which mandated production quotas for automakers. Alongside policy, local manufacturers have developed significant cost advantages by vertically integrating the entire supply chain, ensuring component availability and lower production costs. Crucially, Chinese companies are leading in technological breakthroughs, especially in advanced battery systems and integrating sophisticated software and smart driving features that appeal quickly to younger, tech-savvy buyers.

Leading Position in Battery, Smart Manufacturing, and Supply Chain

The backbone of this ecosystem is its unparalleled supply chain leadership. China controls a massive share of global battery production, with domestic giants dominating the cell-to-pack technology landscape. This is complemented by highly efficient smart manufacturing processes that reduce waste and increase throughput. Chinese EV makers benefit from the localized and competitive component ecosystem, which significantly enhances the speed of innovation and vehicle development.

Export Growth Trends

This domestic success is now fueling global expansion. Chinese EV exports have surged dramatically, with major players aggressively targeting Southeast Asia, the Middle East, and increasingly, Europe. For example, export volumes grew by over 50% year-over-year in 2023, solidifying China’s role as the world’s largest vehicle exporter (Source: General Administration of Customs of China, 2024). This outward push confirms the industry’s profound competitiveness on the international stage.

How We Selected the Top 10 Manufacturers

To provide the most accurate and forward-looking list, our selection process goes beyond simple monthly sales counts. We use a holistic, weighted system to identify companies that are building long-term, global influence, not just short-term domestic success.

Core Ranking Criteria: A Balanced Scorecard

Our ranking relies on a balance of quantitative performance and qualitative strategic strength. While Sales Volume and Market Share are foundational, representing over 50% of the overall score, they are balanced by three critical future-oriented factors. These include Technological Innovation (focusing on platform architecture, battery density, and 800V adoption), Product Portfolio Breadth, and, most importantly for global readers, Globalization Capability. The latter assesses the manufacturer’s success in exporting vehicles, establishing overseas production facilities, and gaining international certifications (like E-NCAP or Euro 5/6 standards).

Defining the Scope: NEV Versus BEV

The term “Electric Vehicle” in the global context often means a pure Battery Electric Vehicle (BEV). However, in China, the industry and government use the category New Energy Vehicles (NEVs), which includes BEVs as well as Plug-in Hybrid Electric Vehicles (PHEVs) and Extended Range Electric Vehicles (EREVs). For this ranking, we chose to include the full NEV category. This is crucial because innovators like Li Auto, which specialize in EREVs, represent a major technological and sales force, making them essential players in the complete Chinese EV ecosystem. By including both, we capture the total impact of China’s electrification journey.

Data Sourcing and Verification

To ensure the list is built on reliable data, we rely on official, publicly available information. Our primary sources include aggregated data from the China Association of Automobile Manufacturers (CAAM) and the China Passenger Car Association (CPCA), which track official registration and retail delivery numbers. For globalization metrics, we consulted international shipping manifests and public financial statements to confirm export volumes, such as the estimated 6.2 million vehicles exported by China in 2023 (Source: CAAM, 2024). This rigorous approach ensures that our ranking reflects both market reality and strategic potential.

Top 10 Electric Vehicle Manufacturers in China

The following ten companies represent the vanguard of China’s electric vehicle industry. They include long-established state-owned enterprises (SOEs), traditional automotive giants that successfully pivoted to electric, and aggressive, tech-focused startups. This group collectively dictates pricing, drives innovation, and commands the largest share of both the domestic and rapidly expanding global EV market.

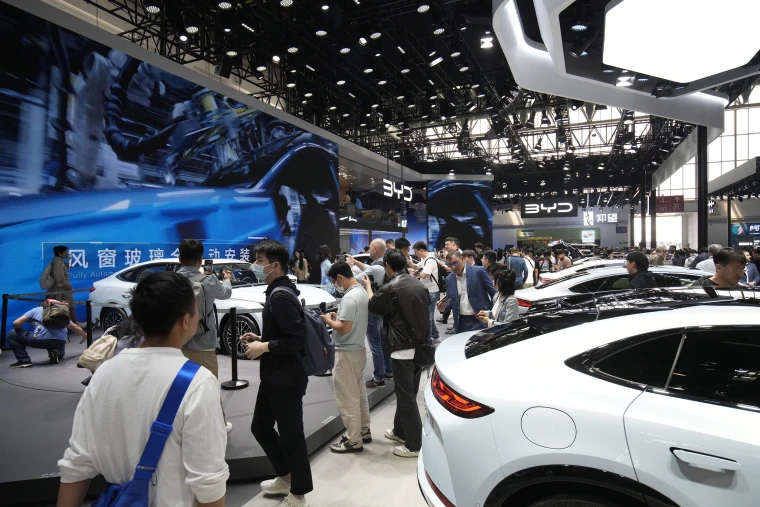

1.BYD (Build Your Dreams)

| Component | Description |

| Brand Overview | BYD transitioned from a battery manufacturer to a global automaker, now recognized as one of the world’s largest EV producers. With a completely vertically integrated supply chain, BYD controls nearly every component, from the semiconductor chips to the battery cells. |

| Key Electric Models | The brand covers nearly every segment with models like the compact Dolphin, the family sedan Seal and Han, and the flagship premium models under the Denza and Yangwang sub-brands. |

| Technology & Innovation Strengths | The core strength is the Blade Battery, a safer, more space-efficient LFP (lithium iron phosphate) battery. BYD also utilizes its own DM-i Super Hybrid technology, making it a leader in both BEV and PHEV sales. |

| Market Position & Segment | BYD dominates the mass-market and mid-to-high-end segments in China. In 2023, BYD sold over 3 million NEVs globally (Source: BYD Filings, 2024). |

| Global Expansion Footprint | Aggressive expansion across Europe, Australia, and South America. It is the first Chinese EV maker to announce or begin construction on multiple overseas production plants, including Thailand, Brazil, and Hungary. |

| Why It Stands Out | Vertical integration and mastery of battery technology provide an unmatched cost advantage and production scale. |

2.SAIC Motor (MG / IM Motors / Roewe)

| Component | Description |

| Brand Overview | SAIC is a major state-owned enterprise (SOE) and partner to global brands. It uses its historically strong brands, notably the British-originated MG, to lead its electric export strategy. |

| Key Electric Models | The MG ZS EV and MG 4 (Mulan) are key volume drivers globally. Domestically, IM Motors targets the premium intelligent segment, competing with startups. |

| Technology & Innovation Strengths | SAIC emphasizes its intelligent and scalable architecture, including the Nebula platform. The MG 4 is known for its “rubik’s cube battery” technology designed for easy maintenance and replacement. |

| Market Position & Segment | SAIC is a powerful international player, consistently ranking as the largest Chinese vehicle exporter. The MG brand focuses on affordable electric models for international buyers. |

| Global Expansion Footprint | MG has significant sales and brand presence across Europe, the UK, Australia, and India, with over 1 million units exported in 2023 (Source: SAIC Filings, 2024). |

| Why It Stands Out | Unparalleled global sales network and export volume, utilizing the established trust of the MG brand internationally. |

3.Geely Holding Group (Zeekr / Geometry etc.)

| Component | Description |

| Brand Overview | Geely is a powerful private automotive group that owns Volvo and Lotus. Its EV strategy is decentralized, led by several distinct high-tech brands targeting different consumer groups. |

| Key Electric Models | Zeekr 001 and 007 (premium/performance BEVs), and various models under the Geometry and Lynk & Co brands. |

| Technology & Innovation Strengths | Geely’s foundation is the modular Sustainable Experience Architecture (SEA), a BEV-only platform designed for flexible sizing and 800V high-voltage systems, shared across its multiple brands (including Volvo/Polestar). |

| Market Position & Segment | Zeekr focuses on the premium, performance-oriented segment, challenging brands like NIO and Tesla in China’s upper-mid-market. |

| Global Expansion Footprint | Zeekr has begun deliveries in Europe (Sweden, Netherlands) and is actively expanding its sales and service network in preparation for a major push. |

| Why It Stands Out | The highly flexible SEA platform and access to premium engineering and safety standards from its global subsidiaries (Volvo). |

4.GAC Group (Aion / Hyper)

| Component | Description |

| Brand Overview | Guangzhou Automobile Group (GAC) is a major SOE that spun off its EV division, GAC Aion, which has quickly become a top-tier mass-market EV producer. Hyper is its new luxury sub-brand. |

| Key Electric Models | The Aion Y (family crossover) and Aion S (sedan) drive high domestic volume. The premium Hyper GT and Hyper HT showcase its high-end ambitions. |

| Technology & Innovation Strengths | Aion is pioneering ultra-fast charging technology, claiming the ability to achieve 480kW charging and add hundreds of kilometers of range in minutes (Source: GAC Technology Roadmap, 2024). They also utilize proprietary battery swapping technology. |

| Market Position & Segment | Aion is a mass-market volume leader, particularly strong in fleet operations and the taxi market, but is aggressively moving into the mid-to-high-end with the Hyper brand. |

| Global Expansion Footprint | Primary focus has been Southeast Asia (Thailand, Indonesia), where it is establishing production hubs and local sales networks to challenge Japanese brands. |

| Why It Stands Out | Leadership in ultra-fast charging technology and strong performance in the high-volume taxi and fleet market. |

5.Changan Automobile (Deepal / AVATR)

| Component | Description |

| Brand Overview | Changan is a long-established Chinese state-owned enterprise (SOE) that has rapidly invested in electrification. Its EV strategy is driven by specialized brands: Deepal (Shenlan) targets the mass-market, and AVATR is a high-end brand developed in partnership with Huawei and CATL. |

| Key Electric Models | Deepal SL03 (sedan) and S7 (SUV) are volume sellers. AVATR 11 and 12 are flagship luxury crossovers known for their advanced smart technology package from Huawei. |

| Technology & Innovation Strengths | Changan leverages its SDA (Software Defined Architecture) platform, allowing rapid software updates and feature iteration. AVATR specifically benefits from Huawei’s HarmonyOS smart cockpit and advanced driver-assistance systems (ADAS). |

| Market Position & Segment | Changan covers the mainstream market through its main brand and the Deepal series, while AVATR competes directly in the highly competitive premium segment against NIO and Li Auto. |

| Global Expansion Footprint | Primarily focused on exporting cost-effective models to Southeast Asia, Russia, and the Middle East, leveraging its established manufacturing footprint. |

| Why It Stands Out | Strategic collaboration with Huawei gives the AVATR brand a massive edge in terms of high-level intelligent driving and digital cabin experiences. |

6.Great Wall Motor (ORA / WEY)

| Component | Description |

| Brand Overview | Great Wall Motor (GWM) is a major SUV and truck specialist that has diversified its portfolio with unique, targeted EV sub-brands. ORA focuses on fashionable, youth-oriented BEVs, and WEY handles the premium hybrid segment. |

| Key Electric Models | The ORA Good Cat (Haomao) is popular for its distinctive retro-modern design and has achieved global recognition. The WEY Mocha PHEV targets the high-end SUV segment. |

| Technology & Innovation Strengths | GWM utilizes the dedicated Lemon platform for its hybrids and the Coffee Intelligence system for smart cockpit and driving functions. Its strength lies in specialized design and manufacturing. |

| Market Position & Segment | ORA is strongly positioned in the compact, lifestyle BEV market, appealing particularly to female buyers. GWM is successfully establishing its brands internationally based on bold design. |

| Global Expansion Footprint | The ORA brand is actively selling in Europe, Australia, and Thailand, often performing well due to its unique styling and good safety ratings. |

| Why It Stands Out | Targeted design and branding (especially ORA) that successfully differentiates its electric models in a crowded market. |

7.Li Auto

| Component | Description |

| Brand Overview | Li Auto is one of the “Nio, Xpeng, Li” trio of prominent Chinese EV startups. It carved out a unique niche by focusing almost exclusively on Extended Range Electric Vehicles (EREVs), also known as PHEVs, catering specifically to large families. |

| Key Electric Models | The Li L9, L8, and L7 are all large, six- or seven-seater premium SUVs known for their comfortable interiors, long total range, and sophisticated cockpit technology. |

| Technology & Innovation Strengths | The EREV system eliminates range anxiety by combining a powerful battery with a small gasoline generator, allowing long-distance travel without frequent charging. The vehicles are renowned for their user-friendly software and advanced interior amenities. |

| Market Position & Segment | Dominates the premium family SUV segment in China, consistently achieving high sales volumes due to its practical technology and large vehicle size. |

| Global Expansion Footprint | Historically focused intensely on the profitable domestic market, Li Auto has only recently begun exploring export opportunities, focusing on high-demand Asian markets initially. |

| Why It Stands Out | Unwavering focus on family-centric EREVs and superior interior user experience, which resonates strongly with its target demographic. |

8.NIO

| Component | Description |

| Brand Overview | NIO is known for positioning itself as a premium, user-centric lifestyle brand, often dubbed the “Chinese Tesla” for its high-end positioning and dedicated user community. |

| Key Electric Models | The ET5 (sedan), ES6 (SUV), and the flagship ET7 are its main models. NIO’s strategy is heavily reliant on its unique service infrastructure. |

| Technology & Innovation Strengths | NIO’s core technology is its Battery-as-a-Service (BaaS) subscription model and the massive Power Swap Network. This allows drivers to exchange a depleted battery for a fully charged one in minutes, bypassing long charging times. |

| Market Position & Segment | Sits firmly in the luxury and high-end market, competing with traditional German luxury brands. Its subscription-based services focus on customer retention and premium loyalty. |

| Global Expansion Footprint | Aggressively expanding into Europe, particularly Norway, Germany, Sweden, and the Netherlands, bringing its unique BaaS and Power Swap service model with it. |

| Why It Stands Out | The revolutionary Battery Swap system provides a superior convenience and solves range anxiety in a unique, rapid way. |

9.XPeng Motors

| Component | Description |

| Brand Overview | XPeng is a tech-focused startup often compared to Tesla due to its deep focus on self-driving technology and software integration. It prioritizes the “smart” experience above all else. |

| Key Electric Models | The P7 (sports sedan) and G6 (mid-sized SUV) are key volume drivers. The X9 MPV showcases its expanded vehicle segments. |

| Technology & Innovation Strengths | XPeng is a leader in Advanced Driver Assistance Systems (ADAS), known in China as XNGP. It also pioneered the deployment of 800V high-voltage platforms and self-built high-speed charging stations to maximize efficiency. |

| Market Position & Segment | Primarily targets tech-savvy, younger buyers in the mid-to-high-end BEV segment who value cutting-edge software and autonomous capabilities. |

| Global Expansion Footprint | Focused on expanding across the European continent, especially in Scandinavia, leveraging its technology-first approach to attract buyers. |

| Why It Stands Out | Market leader in full-stack autonomous driving R&D and rapid ADAS feature rollout. |

10.Wuling

| Component | Description |

| Brand Overview | A joint venture between SAIC, General Motors (GM), and Wuling, this brand dominates the entry-level EV market with micro-cars, prioritizing accessibility and affordability. |

| Key Electric Models | The incredibly popular Hongguang Mini EV, which became a viral sensation and, for a time, was China’s best-selling EV. The Bingo offers a slightly larger, more contemporary option. |

| Technology & Innovation Strengths | While light on sophisticated ADAS, Wuling’s strength is its low-cost manufacturing and ability to produce reliable, basic urban mobility vehicles at high volume. |

| Market Position & Segment | Absolute dominance in the entry-level and urban commuter segments, making electric mobility accessible to the widest possible audience. |

| Global Expansion Footprint | Limited global export, though some models are licensed or exported to developing Asian and Middle Eastern markets under various names. |

| Why It Stands Out | Unmatched affordability and volume in the micro-EV segment, driving mass adoption in Chinese cities. |

The Role of China’s EV Supply Chain and Charging Infrastructure

The remarkable success of China’s electric vehicle manufacturers is built upon an equally dominant and advanced support system. This ecosystem includes the world’s most sophisticated and vertically integrated supply chain, giving Chinese firms significant cost advantages and unparalleled speed in technology deployment.

Why China Leads in EV Infrastructure

China’s leadership in EV adoption is primarily rooted in its infrastructure strategy. The country boasts the world’s largest charging network by far, thanks to a concerted effort driven by government mandates, massive investment from automakers, and rapid construction by equipment companies. This infrastructure scale directly addresses consumer range anxiety, fueling mass adoption. Currently, China accounts for over 60% of the world’s public charging points (Source: IEA Global EV Outlook, 2024). Furthermore, the industry is quickly maturing technical standards around high-power DC fast charging and 800-volt high-voltage vehicle platforms, ensuring future-proof compatibility. Adoption of international communication standards like OCPP (Open Charge Point Protocol) also ensures seamless integration of domestic charging hardware into global markets.

Key Components of the EV Supply Chain

The complete Chinese EV supply chain is a highly localized and competitive ecosystem spanning several key areas. First is Battery and Cell Manufacturing, dominated by global leaders like CATL and BYD, who control raw material sourcing and production processes to ensure cost efficiency. Second is the rapid development of Electric Drive Systems, where manufacturers are increasingly integrating motors, reducers, and power electronics into single, efficient units. Third, and most critical for deployment, is Charging Piles and Power Electronics, which are rapidly evolving to handle higher voltages and power outputs. Finally, the integration of Energy Storage (ESS) and Photovoltaic (PV) solutions is creating “PV + Storage + Charging” integrated stations, transforming charging from a simple utility service into a part of a wider, intelligent energy management system.

Leading EV Charging Equipment Manufacturers in China

Chinese manufacturers of charging equipment and overall solutions possess significant competitive advantages in the global arena, driven by sheer domestic scale and ruthless cost optimization. Their core strength lies in advanced power module technology—the brains of the DC fast charger—which they develop and manufacture in-house, ensuring robust performance and modular design flexibility. This domestic expertise has translated into a strong export trend, with Chinese charging manufacturers playing a vital role in providing cost-effective and high-performance hardware to global partners, enabling the expansion of charging networks in Europe, North America, and emerging markets. These firms are now essential partners in developing future international charging standards and high-speed networks.

Company Spotlight: OLINK

Company Overview

OLINK is a leading Chinese provider specializing in comprehensive electric vehicle charging and energy management solutions, bridging the gap between vehicle manufacturing and power infrastructure. The company focuses on delivering reliable, cost-effective, and smart charging hardware and software management platforms for various commercial and domestic needs globally.

Core Products

OLINK’s portfolio covers the full range of charging needs, including compact AC chargers for residential and workplace use, powerful DC fast chargers designed for public stations and highway corridors, specialized EV charging adapters for compatibility across different standards, durable portable EV chargers for emergency or travel use, and integrated ESS + PV solutions that combine solar energy generation, storage, and vehicle charging in one package.

Technology Strengths

The company’s competitive edge rests on its advanced technology, including the design and in-house production of its own power modules, which ensures high power density and stability. OLINK offers high-power fast-charging solutions (up to 800kW) and full compliance with international standards like OCPP for seamless network operations. Its integrated solutions provide complete full-station management software for efficient operation and maintenance.

Global Certifications

A commitment to international markets is underlined by its extensive range of global certifications, including CE, RoHS,TUV, CSA , FCC and UL and special certificates for some area markets.

Export Markets

OLINK maintains a robust global presence, exporting to over 50 countries, with significant coverage across key regions including Europe (e.g., Germany, UK), North America (US, Canada), and rapidly expanding its footprint across Southeast Asia and the Middle East.

Key Application Scenarios

The company’s solutions are implemented across diverse environments, from large-scale commercial charging stations and convenience stores to individual home charging systems and dedicated fleet charging depots. Its PV+ESS solutions are key components for developing resilient, grid-independent charging at remote sites and gas stations.

Why the Company Matters in China’s EV Ecosystem

OLINK is critical because it democratizes high-quality charging infrastructure globally. By providing sophisticated yet cost-competitive hardware that meets stringent global safety and technical standards, it acts as a crucial enabler for Chinese (and international) automakers to expand their EV sales worldwide, ensuring that the necessary charging network is available for mass adoption.

Comparison Table: Top 10 EV Manufacturers at a Glance

This table provides a quick reference to the strategic focus, key models, and technological advantages of China’s leading electric vehicle companies, reflecting their diverse approaches to the global market.

| Brand | Founded | Key Models | Type (Primary Focus) | Price Range (CN¥ Estimate) | Technology Highlights | Export Markets | Target Customer Segment |

| BYD | 2003 (Auto) | Seal, Han, Dolphin | BEV / PHEV (DM-i) | ¥73,800 – ¥800,000+ | Blade Battery, High Vertical Integration, DM-i Hybrid | Europe, Australia, Southeast Asia, S. America | Mass Market to Mid-High Volume |

| SAIC Motor | 1955 (Parent) | MG 4, MG ZS EV, IM L7 | BEV / PHEV | ¥120,000 – ¥450,000+ | Nebula Platform, Largest Export Volume, “Rubik’s Cube” Battery | Europe (UK/DE), India, Australia (Global Exporter) | Global Affordable EV, Domestic Premium |

| Geely Holding | 1986 (Parent) | Zeekr 001, Zeekr 007 | BEV / PHEV | ¥120,000 – ¥400,000+ | Sustainable Experience Architecture (SEA), 800V Readiness | Europe (Scandinavia, Netherlands) | Premium Performance BEV |

| GAC Group | 2017 (Aion) | Aion Y, Hyper GT | BEV / PHEV | ¥140,000 – ¥350,000+ | Ultra-Fast 480kW Charging, Proprietary Battery Tech | Southeast Asia (Thailand, Indonesia) | Mass Market/Fleet (Aion) & High-End (Hyper) |

| Changan Auto | 1862 (Parent) | Deepal SL03, AVATR 11 | BEV / EREV | ¥150,000 – ¥600,000+ | Huawei-Powered Smart Systems (ADAS/Cockpit), SDA Platform | Southeast Asia, Russia, Middle East | Tech-Savvy Youth, High-End Luxury |

| Great Wall Motor | 1984 (Parent) | ORA Good Cat | BEV / PHEV | ¥100,000 – ¥250,000+ | Lemon Platform, Targeted Lifestyle Branding (ORA) | Europe, Australia, Thailand | Fashion-Conscious Buyers, Specialized Segments |

| Li Auto | 2015 | Li L9, L8, L7 (SUVs) | EREV (Range Extender) | ¥300,000 – ¥500,000+ | Superior Cabin Experience, EREV System for Range Anxiety | Focused on high-demand Asian markets (Initial) | Premium Large Family SUV Buyers |

| NIO | 2014 | ET5, ES6, ET7 | BEV | ¥300,000 – ¥650,000+ | Power Swap Network, Battery-as-a-Service (BaaS) | Europe (Norway, Germany, Netherlands) | Luxury/Premium Buyers Seeking Service/Lifestyle |

| XPeng Motors | 2014 | P7, G6, X9 | BEV | ¥180,000 – ¥400,000+ | Full-Stack XNGP ADAS, 800V High-Voltage Architecture | Europe (Scandinavia) | Tech-Savvy Consumers Prioritizing Autonomy/Software |

| Wuling (SGMW) | 2002 (JV) | Hongguang Mini EV, Bingo | BEV | ¥30,000 – ¥90,000 | Ultra-Low Cost, Highest Volume in Entry-Level Market | Limited, developing Asian markets | Entry-Level, Urban Commuters, Budget Buyers |

China vs. Global EV Manufacturers: Key Insights

The global electric vehicle market is defined by a fierce three-way competition between China’s domestic champions, Tesla’s pioneering technology, and established European automakers. China’s primary strength is a structural, unmatchable advantage in manufacturing efficiency and absolute control over the core components required to build an EV.

China vs. Tesla vs. European Brands Comparison

The competitive dynamic has shifted from a technology race to a race for scale and affordability. While Tesla maintains its lead in software and BEV efficiency, and European brands rely on decades of established luxury appeal, Chinese automakers have achieved a commanding global market share. By the end of 2023, Chinese brands accounted for over 55% of global NEV sales, significantly outpacing both Western rivals combined (Source: S&P Global Mobility, 2024). This domestic high-volume foundation allows for relentless price competition, offering a greater variety of models at every price point.

Cost Structure Advantage

Chinese manufacturers benefit from a massive cost structure advantage over their international peers. Analysts estimate that Chinese EVs can be produced for 10% to 20% less than comparable models built in Europe or the US (Source: Rhodium Group Analysis, 2024). This cost gap is the result of deep vertical integration—controlling everything from raw materials to final assembly—and fierce, localized competition among suppliers. This efficiency allows Chinese brands to launch price wars, making it difficult for foreign rivals to compete on margin while maintaining high quality.

Battery Supply Chain Absolute Leading Position

The most powerful weapon in China’s arsenal is its absolute control over the EV battery supply chain. China holds nearly 75% of the global manufacturing capacity for lithium-ion battery cells (Source: BloombergNEF, 2024). Domestic giants like CATL and BYD lead R&D in critical chemistries, particularly the safer and cheaper Lithium Iron Phosphate (LFP) technology. This dominant position dictates the cost and speed of innovation for almost every global automaker, positioning China as the indispensable core of the EV revolution.

Charging Equipment “Made in China” Global Advantage

China’s industrial strength extends beyond the vehicle to the charging ecosystem. The country is the world’s leading exporter of charging equipment, specifically high-power DC charging modules. The highly efficient and cost-competitive production of this hardware gives Chinese firms a significant global hardware advantage. Companies like OLINK are now crucial suppliers to charging networks worldwide, exporting robust, technologically advanced, and internationally certified charging stations (UL/CE standards), ensuring that China’s influence on global EV adoption happens at the pump as well as the dealership.

Future Trends in China’s EV Industry

China is not only dominating the present EV market but is also aggressively shaping its future through innovation in battery chemistry, high-voltage architecture, and smart driving systems. These trends solidify China’s position as the global laboratory for next-generation mobility.

Technological Leapfrogging

The industry is in a fierce race to adopt 800V High-Voltage Fast Charging platforms. This technology dramatically reduces charging times, making long-distance EV travel much more convenient. As of late 2025, the proportion of new Chinese EV models featuring 800V architecture is rapidly increasing, pushing the entire market toward ultra-fast charging speeds. Simultaneously, battery technology is progressing from traditional lithium-ion to Semi-Solid and Solid-State Batteries, promising higher energy density and greater safety. Furthermore, the Battery Swapping model, pioneered by companies like NIO, offers a quick three-minute alternative to charging, with over 3,000 swapping stations already deployed across China (Source: NIO Official Data, Q3 2025).

The Rise of Intelligence and AI

Chinese consumers highly value integrated digital experiences, making AI and Intelligent Driving features a key competitive battleground. Domestic brands are quickly closing the gap with global leaders in this space. It is anticipated that vehicles equipped with Level 2 (L2) and above autonomous driving systems will exceed 50% of new vehicle sales by 2025 (Source: KPMG/CAICV Technology Roadmap, 2025). This rapid adoption of advanced driver assistance systems (ADAS) is creating an unprecedented volume of real-world data, accelerating the development of fully autonomous driving capabilities, especially for urban navigation.

Global Expansion and Energy Integration

The momentum of New Energy Vehicle (NEV) Exports is set for continued explosion. China is leveraging its cost and production advantages to target new overseas markets. In the first ten months of 2025, China’s NEV exports totaled over 2 million units, representing a massive 90.4% year-over-year increase (Source: CAAM, November 2025). This expansion is driving the need for sophisticated infrastructure solutions. The final major trend is the integration of Photovoltaic (PV) + Energy Storage (ESS) + Ultra-Charging Stations. This “PV-Storage-Charging” model stabilizes the grid, maximizes the use of solar energy, and transforms charging stations into localized energy hubs, ensuring China’s EV revolution is also a clean energy revolution.

Conclusion: Shaping the Global Future of EVs

To wrap up our analysis, the story of China’s EV dominance is much bigger than just a few car companies. Its true strength lies in a completely integrated, highly efficient complete ecosystem, from raw materials to final assembly. This vertical control gives Chinese brands an unbeatable advantage on cost and speed.

Looking ahead, expect Chinese brands to become major global players, setting the benchmark for the next generation of electric mobility. They are driving innovation in everything from battery swapping to 800V ultra-fast charging and advanced smart driving systems.

Crucially, don’t overlook the infrastructure firms. The charging equipment manufacturers are the silent heroes, building the global networks and integrated PV+Storage+Charging stations essential for sustaining mass EV adoption worldwide. The future of electric transport will be heavily influenced by this Chinese ecosystem.