Introduction

In recent years, the global automotive industry has been experiencing a significant transformation towards new energy vehicles, driven by factors such as environmental concerns and technological advancements. Amid this trend, Chinese GB-standard EVs are rapidly expanding in Europe. Despite challenges like charging standard mismatches, they’re breaking through with innovation and localization. This report unveils the strategies turning obstacles into new opportunities for growth.

Performance of Chinese National Standard Vehicles in the European Market

Export Volume and Sales Growth

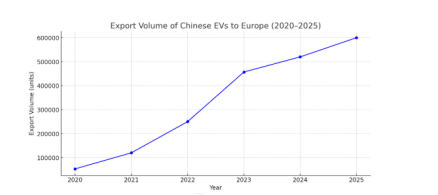

From 2020 to 2025, the export volume and sales of Chinese national standard vehicles in Europe have shown a remarkable upward trend. In 2020, the export volume of Chinese new energy vehicles to Europe was approximately 53,000 units. By 2023, this number had skyrocketed to around 457,000 units, with an expected further increase to 600,000 units in 2025, representing a compound annual growth rate of over 60%.

In terms of sales amount, in 2020, the sales of Chinese new energy vehicles in Europe were about €1.5 billion. In 2023, it reached €8 billion, and is projected to hit €12 billion in 2025, with a significant growth rate year – on – year.

[Insert Figure 1: Export Volume of Chinese New Energy Vehicles to Europe (2020 – 2025 Estimated)]

Note: Specific data sources from Eurostat, China Association of Automobile Manufacturers

H3 Market Share Changes

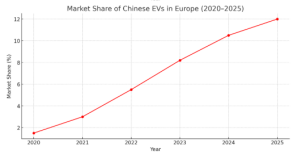

The market share of Chinese GB-standard vehicles in the European electric vehicle market has been steadily rising. In 2020, it accounted for only about 1.5% of the European electric vehicle market. In 2023, this share had increased to 8.2%, and by 2025, it is expected to reach around 12%. This growth indicates that Chinese vehicles are gradually winning over European consumers and gaining a more prominent position in the market.

[Insert Figure 2: Market Share of Chinese GB-standard vehicles in the European EV Market (2020 – 2025 Estimated)]

Note: Specific data sources from JATO Dynamics, ACEA

Best – Selling Brands and Models

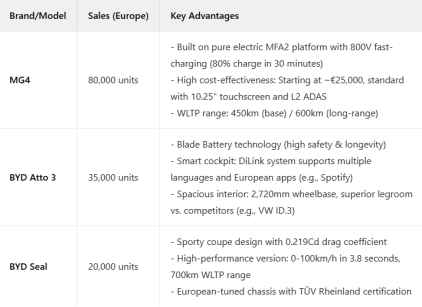

Several Chinese brands and models have achieved remarkable success in the European market. MG, for example, has been a top performer. In 2024, MG sold approximately 180,000 units in Europe. The MG4 is one of its best – selling models, with sales reaching 80,000 units in 2024.

BYD has also made significant inroads. In 2024, BYD’s sales in Europe totaled around 60,000 units. The BYD Atto 3 and BYD Seal have been well – received by European consumers. The Atto 3 sold 35,000 units, and the Seal sold 20,000 units in 2024.

[Comparison of Chinese EV Models in the European Market (2024)]

The meaning of Chinese GB-standard vehicles surpasses Tesla in electric car sales in Europe

April, 2025, BYD surpassing Tesla in the European market marks the first time a Chinese EV brand has directly challenged a global industry leader on its home turf. This reflects China’s rising technological strength and international acceptance. It also signals a clear shift in the EV market—from Tesla’s dominance to a more diversified, multipolar competition landscape.

H2 Reasons for the Rapid Development of Chinese National Standard Vehicles in the European Market

Technological Advantages

Chinese national standard vehicles have made significant progress in battery technology. For example, some Chinese brand models, like the NIO ET7, can achieve a range of over 700 kilometers on a single charge, far exceeding many European – made electric vehicles in terms of cruising range. In addition, the charging speed has also been greatly improved. The XPeng G9 can charge to 80% in just 30 minutes, which is much faster than some of its European counterparts.

[Parameter Comparision of Chinese electric vehicles with mainstream European electric vehicles ]

Cost – Effectiveness

When compared with European – made vehicles of the same class, Chinese national standard vehicles offer a distinct price advantage. A mid – size electric SUV from a Chinese brand may be priced at around €30,000, while a similar – sized and – equipped European brand vehicle could cost €40,000 or more. Despite the lower price, Chinese vehicles often come with more comprehensive configurations. They are more likely to be equipped with advanced features such as panoramic sunroofs, high – quality sound systems, and multiple airbags as standard, providing consumers with more value for their money.

Product Innovation

Chinese vehicles are at the forefront of product innovation. Many models are equipped with advanced intelligent driving assistance systems. For example, the Huawei – assisted driving system in some Chinese cars can handle complex traffic situations such as automatic lane – changing and traffic – jam assist with high precision. In – car smart connectivity systems are also a highlight. The BYD DiLink system supports multiple languages and has a high compatibility rate with local applications, allowing users to seamlessly integrate with their digital lives

Real-application Challenges and Solution in the European Market

Charging Standard Incompatibility

Challenge

Chinese EVs primarily use the GB/T charging standard, while Europe uses Type 2 (AC) and CCS2 (DC) standards. Without proper modifications, Chinese vehicles cannot use most European public chargers.

Solution

A:Solution-Chinese GB-standard vehicles Manufacturer

-Overseas models are replaced with European standard charging interfaces

MG: MG4, MG ZS EV and other models sold in Europe are equipped with CCS2 interfaces at the factory, without additional adapters, and are fully compatible with the European charging network.

BYD: Atto 3, Seal and other models exported to Europe are all replaced with Type 2 + CCS2 combinations and adapted to the European OCPP protocol.

–Recalibration of the vehicle charging system

Car companies rewrite and adapt the charging management system (CMS) and battery management system (BMS) to the European voltage, current and safety protocols.

For example: The DC fast charging port of the European version of XPeng G9 not only supports CCS2, but its voltage and current curves are redesigned to adapt to the European power output environment.

B.Solution- EV Adapter Manufacturer

Research and development of dedicated adapter equipment: Some third-party manufacturers such as PHOENIX CONTACT, ABB, and Olink(the first third-party adapter manufacturer other than Tesla’s official one) have developed high-power conversion connectors for GB/T ↔CCS2 and GB/T ↔Type2, which support safety locking and protocol conversion.

Portable adapter market expansion: Portable conversion guns (such as those launched by Setec Power and Efacec) allow some vehicles in the European market to avoid completely modifying the charging system, reducing initial investment.

Charging Network Compatibility and Coverage

Challenge

Although Western Europe has relatively dense charging networks, regional disparities remain. Some charging points may not be compatible with Chinese vehicle systems in terms of payment or communication protocols.

Solution

A.Solution-Chinese GB-standard vehicles Manufacturer

Local communication protocol adaptation

Background issue: European charging piles generally adopt the OCPP (Open Charge Point Protocol) protocol, which has compatibility barriers with some Chinese GB systems.

Countermeasures:

BYD, Weilai, Xiaopeng and other brands have made local adjustments to the vehicle charging communication management system (CMS) to enable it to recognize and be compatible with the European standard OCPP protocol.

Upgrade the BMS (battery management system) to make it consistent with the data communication logic of European charging piles, such as real-time SOC transmission, voltage curve response, etc.

B.Solution- EV Charging equipment Manufacturer

Development of multi-standard communication modules (cross-protocol transfer)

Key technologies:

EV charging pile manufacturer such as ABB, Wallbox, and Olink have developed built-in multi-communication protocol modules that support OCPP 1.6/2.0, ISO 15118 (for Plug & Charge), and China GB standard protocols.

Plug-in protocol bridge: supports real-time conversion of communication protocols between Type 2 or CCS2 gun heads and GB vehicle-mounted systems to avoid system misrecognition.

Voltage and Grid Differences

Challenge

Differences in power grid standards between China (220V/380V) and various European countries can result in charging inefficiencies or failure, especially with home wallbox chargers.

Solution

A.Solution-Chinese GB-standard vehicles Manufacturer

-Upgrade OBC (on-board charger)

The European version of XPeng G9 is equipped with a new 11kW three-phase AC OBC, which supports higher power slow charging and fully matches the 400V three-phase power grid in Germany/France.

-Cooperate with local power and charging pile companies

When NIO built a battery swap station in Germany, it cooperated with local power grid operators to optimize the peak and valley strategy of the battery swap station, alleviate voltage shocks, and improve power output stability.

-Localization of home slow charging solutions

BYD and NIO provide customized home charging pile package installation services to European car owners, supporting local voltage systems while ensuring compatibility with CE certification and TÜV standards.

B.Solution- EV Charging equipment Manufacturer

For example, companies such as Wallbox (Spain) and Olink (China) have launched wall-mounted chargers that support automatic grid adaptation, with multi-voltage input, dynamic current distribution, frequency recognition and other capabilities, and can adapt to European, Chinese and American standards at the same time.

Introducing software and hardware isolation modules: Prevent the inverter or battery management system from burning out due to unstable voltage, and improve electrical safety between vehicles and charging piles.

Future Outlook

Market Share and Sales Growth Projection

Looking ahead, it is expected that the market share of Chinese national standard vehicles in the European market will continue to grow. By 2030, the market share is projected to reach around 20%, and the sales volume is expected to reach 2 million units. This growth will be driven by factors such as continuous technological innovation, further improvement in brand image, and the expansion of localized production.

Long – Term Opportunities and Potential Risks

The continuous growth of the European new energy vehicle market presents a significant opportunity for Chinese automakers. As environmental regulations in Europe become more stringent, the demand for electric vehicles will continue to increase. However, there are also potential risks. Trade frictions may escalate, leading to higher tariffs or more restrictive trade policies. In addition, the continuous evolution of technical standards in Europe may pose challenges for Chinese automakers to keep up with and meet these new requirements.

Conclusion

Chinese GB-standard EVs are making remarkable inroads in Europe, overcoming hurdles like charging standard mismatches through innovation and localization. Brands like BYD and MG are gaining consumer trust with advanced technologies and competitive products. By adapting charging interfaces, optimizing communication protocols, and upgrading onboard systems, Chinese automakers and Chinese EV charging equipments manufacturers are effectively enhancing compatibility with Europe’s infrastructure.

Looking ahead, the European new energy vehicle market’s growth presents a world of opportunities. Chinese automakers are well-positioned to increase their market share, driven by technological breakthroughs, a stronger brand image, and expanded local production. While challenges such as trade frictions and evolving technical standards remain, the positive trends and proactive strategies indicate a bright future for Chinese EVs in Europe, paving the way for sustainable growth in the global automotive industry.